Investments Performance

1693 Partners Fund

As of June 30, 2022

The William & Mary Foundation, Marshall-Wythe School of Law Foundation, William & Mary Business School Foundation and Murray 1693 Scholars Foundation are all members of the 1693 Partners Fund.

| 1 year | 3 year | 5 year | 10 year | 15 year | |

|---|---|---|---|---|---|

| 1693 Partners Fund1 | (3.5%) | 9.6% | 8.8% | 8.3% | 6.0% |

| Target Benchmark2 | (13.7%) | 5.2% | 5.9% | 6.2% | 4.1% |

1. Fund-level investment performance is presented net of investment manager fees and gross of internal operating expenses.

2. Policy Benchmark: 56% MSCI All Country World Index, 24% Bloomberg Barclays Aggregate Index, 2% Bloomberg Barclays U.S. Credit Index, 8% Bloomberg Barclays U.S. High Yield Index, 10% Bloomberg Commodity Index; Beginning January 1, 2017: 50% MSCI All Country World Index, 15% Russell 2000 Index, 10% Bloomberg Barclays Aggregate Index, 15% HFR Fund of Funds Index, 5% MSCI U.S. REIT Index, 5% S&P North American Natural Resources Index.

Board of Visitors

As of June 30, 2022

| 1 year | 3 year | 5 year | 10 year | 15 year | |

|---|---|---|---|---|---|

| Total BoV Account | (12.7%) | 3.0% | 4.1% | 6.1% | - |

| Target Benchmark | (12.6%) | 3.1% | 4.2% | 6.3% | - |

Business School Foundation

As of June 30, 2022

| 1 year | 3 year | 5 year | 10 year | 15 year | |

|---|---|---|---|---|---|

| Total BSF Account | (5.5%) | - | - | - | - |

| Target Benchmark | (14.1%) | - | - | - | - |

1 year benchmark composed of: Custom Benchmark: 60% MSCI ACWI (Net), 7.5% MSCI ACWI Small Cap (Net), 7.5% MSCI Emerging Markets (Net), 25% Bloomberg U.S. Aggregate Bond

The William & Mary Business School Foundation’s endowments are invested primarily in pooled funds managed by the 1693 Partners Fund and LCG Associates. The William & Mary Business School Foundation began investing some funds with LCG Associates during FY 2022. The estimated average annual return and target benchmark on these combined pools were calculated using industry standard methodology for the fiscal year ending on June 30, 2022. Prior to FY22, endowment assets were primarily invested with the 1693 Partners Fund with returns as shown above.

Muscarelle Museum of Art Foundation

As of June 30, 2022

| 1 year | 3 year | 5 year | 10 year | 15 year | |

|---|---|---|---|---|---|

| Total ART Account | (14.5%) | 3.8% | 4.7% | - | - |

| Target Benchmark | - | - | - | - | - |

Virginia Institute of Marine Science Foundation

As of June 30, 2022

| 1 year | 3 year | 5 year | 10 year | 15 year | |

|---|---|---|---|---|---|

| WAMIT/LCG Associates3 | (14.8%) | (2.7%) | 1.2% | 4.5% | - |

| Policy Benchmark4 | (14.9%) | (3.0%) | 0.9% | 3.6% | - |

3. WAMIT investments as of September 30, 2020; LCG Associates investments beginning April 2021; Investment performance is net of all fees and expenses.

4. April 2021 to present: 52.5% MSCI ACWI, 10% MSCI ACWI Small Cap, 7.5% MSCI Emerging Markets, 25% BloomBarc US Aggregate, 5% T-Bills; October 2020 to April 2021: 100% T-Bills; Prior to October 2020: 56% MSCI All Country World Index, 24% Bloomberg Barclays Aggregate Index, 2% Bloomberg Barclays U.S. Credit Index, 8% Bloomberg Barclays U.S. High Yield Index, 10% Bloomberg Commodity Index; Beginning January 1, 2017: 50% MSCI All Country World Index, 15% Russell 2000 Index, 10% Bloomberg Barclays Aggregate Index, 15% HFR Fund of Funds Index, 5% MSCI U.S. REIT Index, 5% S&P North American Natural Resources Index

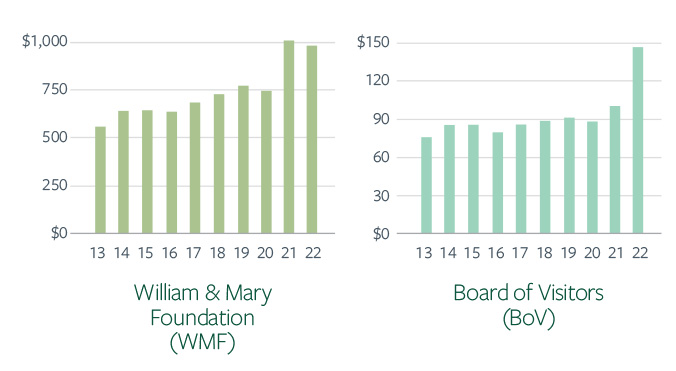

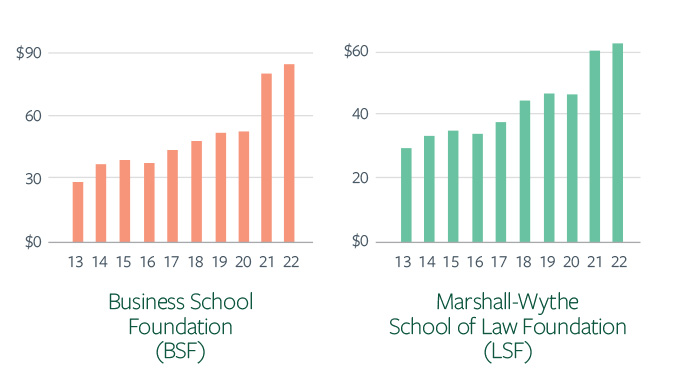

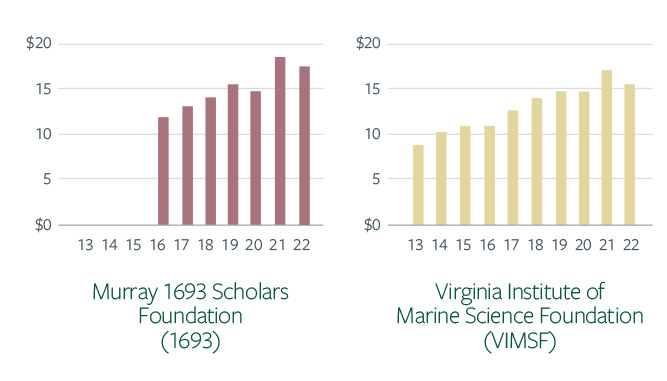

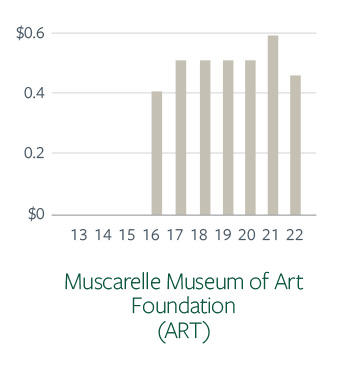

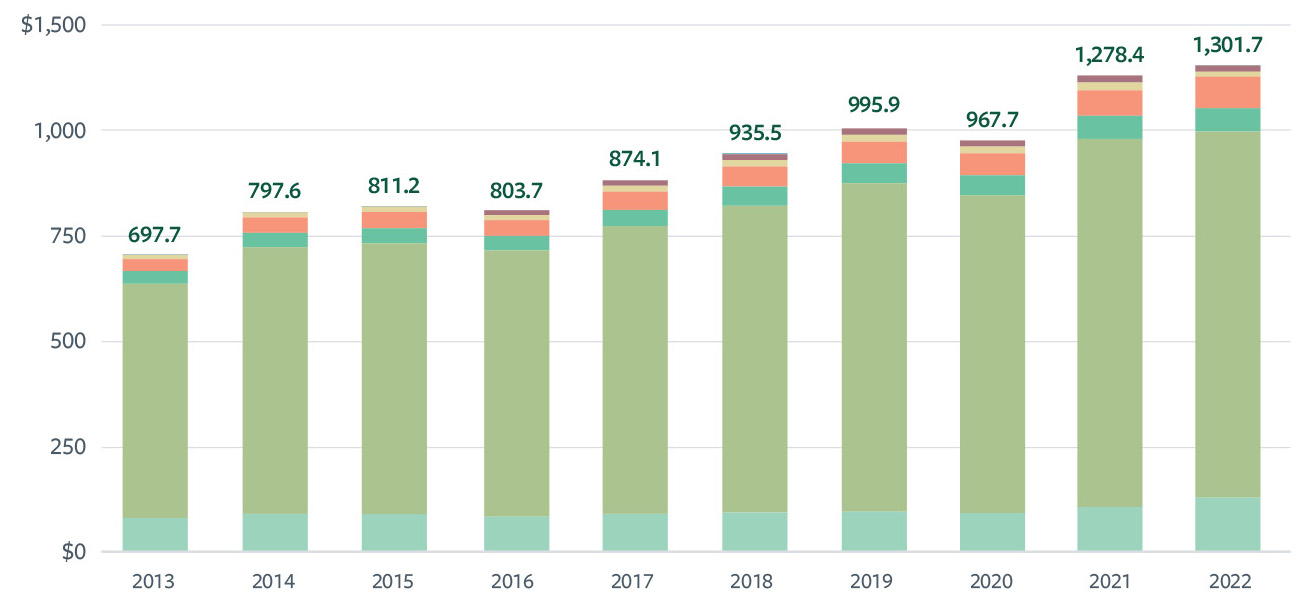

10-Year Growth in Consolidated Endowment

As of June 30, 2022

Scales are different for each pool of capital. Each endowment is represented in the chart below by color.

10-Year Combined Growth for all W&M Endowments

Valued at more than $1.3 billion

As of June 30, 2022

All dollar figures shown in millions.